The Step-by-Step Guide to Filing a Claim After an Intersection Accident

Table of Contents

- Understanding Intersection Accidents in Washington

- Step 1: Prioritize Safety and Call for Help

- Step 2: Document the Accident Scene

- Step 3: Seek Medical Attention Immediately

- Step 4: Notify Your Insurance Company and Begin Your Claim

- Step 5: Prove Fault and Maximize Your Compensation

- Why Working With a Car Accident Lawyer Matters

- Take Action Today

Understanding Intersection Accidents in Washington

Intersection accidents are among the most common and dangerous types of car crashes. Due to the convergence of multiple lanes and traffic directions, these accidents often lead to severe injuries and complex liability disputes. Common causes include failure to yield, running red lights, distracted driving, speeding, and poor visibility.

In Washington State, determining fault in an intersection accident can be challenging, as multiple parties may share responsibility. To protect your rights and improve your chances of securing fair compensation, it’s crucial to follow the right steps after a crash.

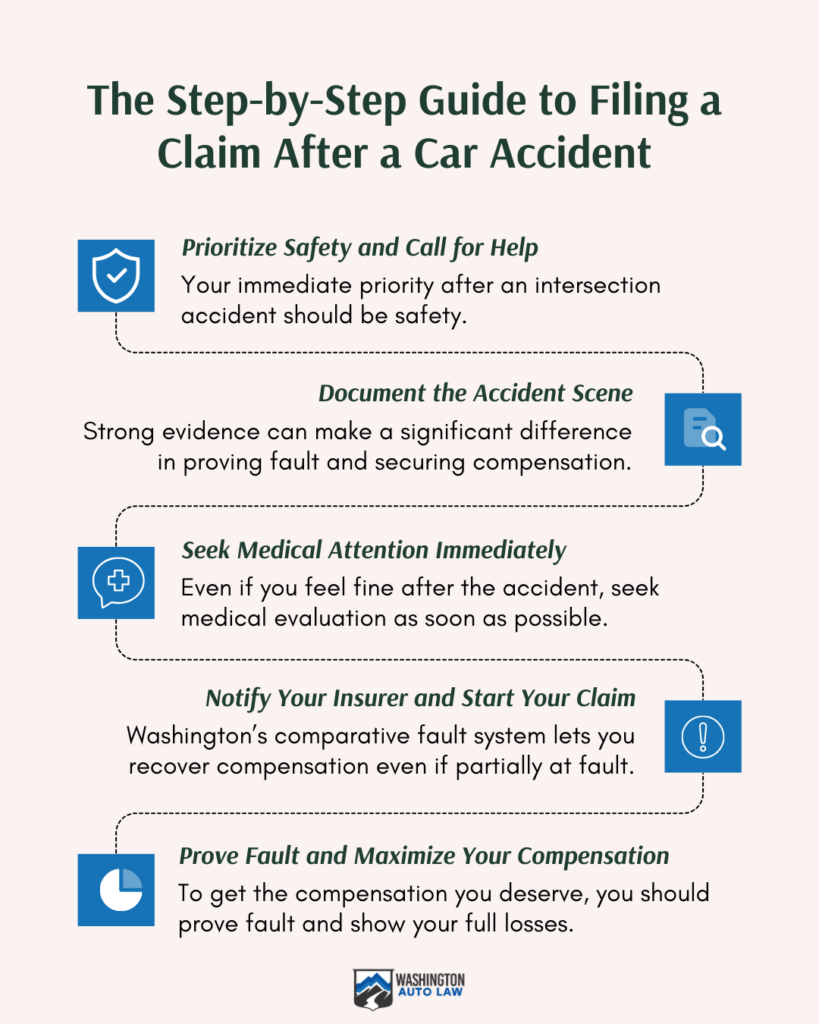

Step 1: Prioritize Safety and Call for Help

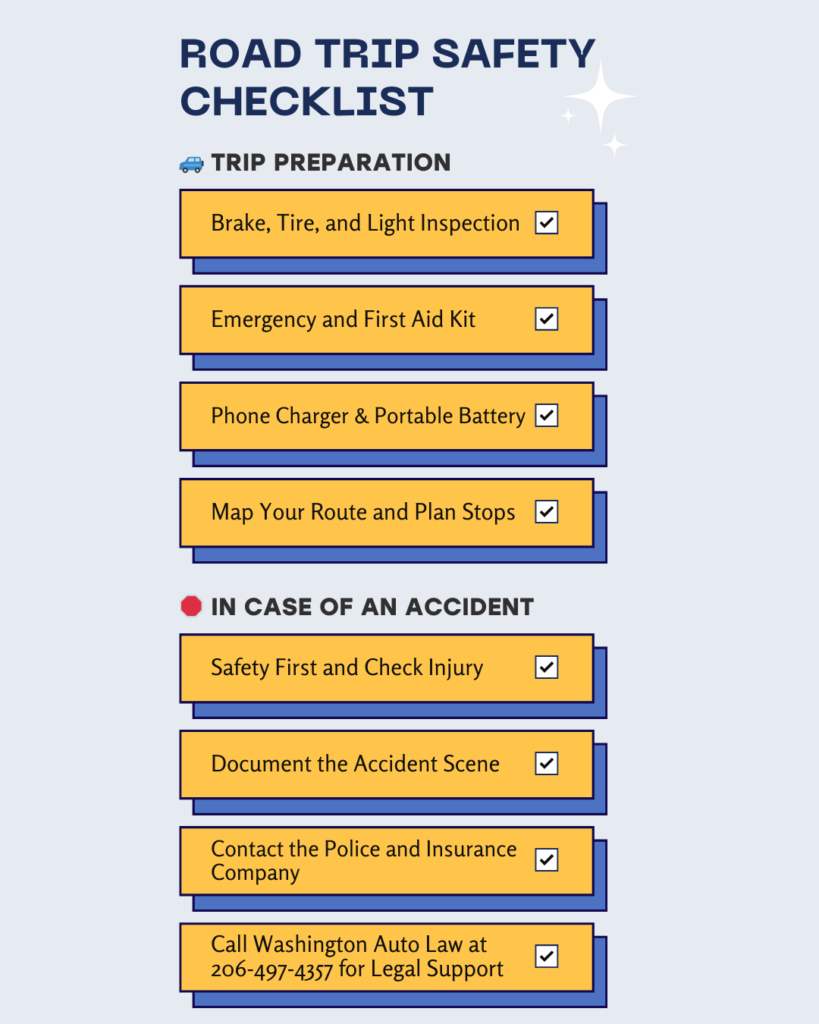

Your immediate priority after an intersection accident should be safety. If possible, move your vehicle out of traffic to a safer location without leaving the accident scene. Then:

- Check yourself and others for injuries. Even minor collisions can cause hidden injuries that worsen over time.

- Call 911 to report the accident and request medical assistance if necessary. Washington law requires reporting accidents involving injuries or significant property damage.

- Wait for law enforcement to arrive and provide a factual statement. Officers will document key details in a police report, which can serve as crucial evidence later.

- Exchange contact, driver’s license, and insurance details with all involved parties. Avoid discussing fault at the scene.

- Gather witness information. Bystanders can provide objective accounts that help clarify how the accident occurred.

Step 2: Document the Accident Scene

Strong evidence can make a significant difference in proving fault and securing compensation. If you’re physically able, take the time to thoroughly document the scene by:

- Capturing photos and videos of vehicle damage, traffic signals, skid marks, and road conditions.

- Noting critical details such as the time, date, weather, and lighting conditions.

- Asking the responding officer how to obtain a copy of the police report, which can serve as an official accident record.

- Checking nearby businesses or traffic cameras that may have recorded the collision.

Step 3: Seek Medical Attention Immediately

Even if you feel fine after the accident, seek medical evaluation as soon as possible. Some injuries, like concussions, whiplash, and internal trauma, may not present symptoms right away. Delaying medical treatment can:

- Put your health at risk by allowing untreated injuries to worsen.

- Weaken your claim by giving insurance adjusters a reason to argue that your injuries were unrelated to the accident.

- Reduce the value of your claim, as insurers may question the severity of injuries that were not documented immediately.

Keep all medical records, receipts, and doctor’s notes, as they will serve as evidence of your damages.

Step 4: Notify Your Insurance Company and Begin Your Claim

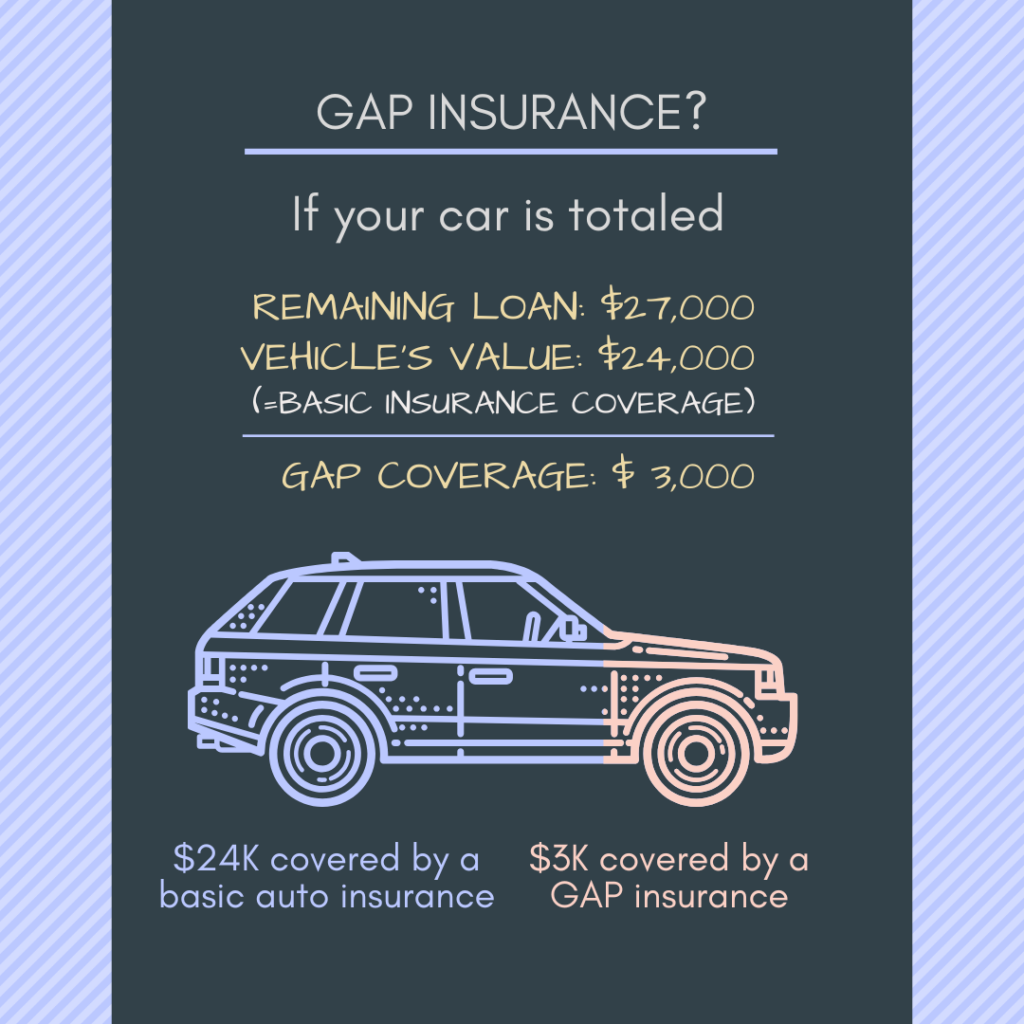

Washington follows a comparative fault system, meaning that even if you were partially at fault, you may still recover compensation. However, insurers often try to minimize payouts, so be cautious when dealing with them.

When reporting your accident:

- Stick to the basic facts without speculating about fault.

- Avoid providing recorded statements without consulting an attorney.

- Keep records of all correspondence, including emails and phone conversations with adjusters.

Depending on the circumstances, you may also need to file a claim with the at-fault driver’s insurance company. If liability is disputed, strong evidence will be crucial in proving fault.

Step 5: Prove Fault and Maximize Your Compensation

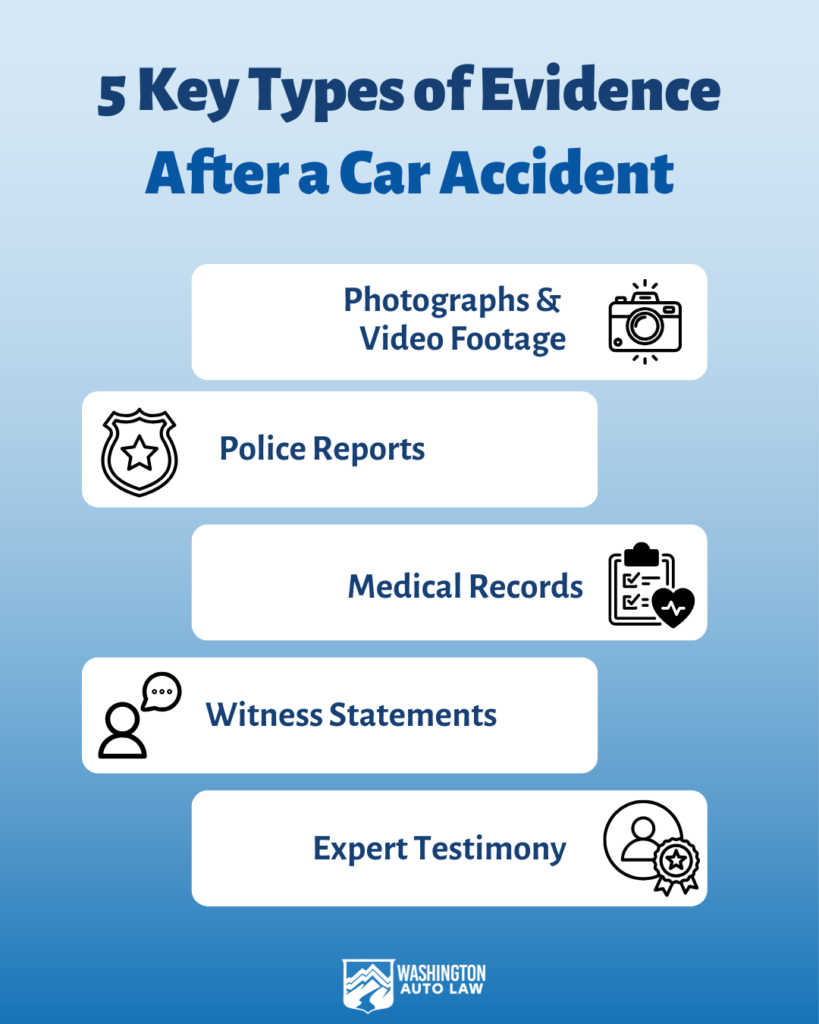

To secure the compensation you deserve, you must establish fault and demonstrate the full extent of your losses. Critical evidence includes:

- Traffic Camera Footage: Intersection cameras or dashcam recordings can provide clear proof of what happened.

- Eyewitness Testimonies: Statements from neutral bystanders can support your version of events.

- Accident Reconstruction Experts: If liability is unclear, professionals can analyze evidence to determine fault.

- Medical Records & Bills: These documents establish a direct link between the accident and your injuries.

- Vehicle Damage Reports: The impact location and severity of damage can indicate who was at fault.

You may be entitled to compensation for:

- Medical expenses (emergency care, hospital visits, physical therapy, and long-term treatment).

- Lost wages (missed work, reduced earning capacity, or disability).

- Property damage (vehicle repairs or replacement).

- Pain and suffering (emotional distress, trauma, and diminished quality of life).

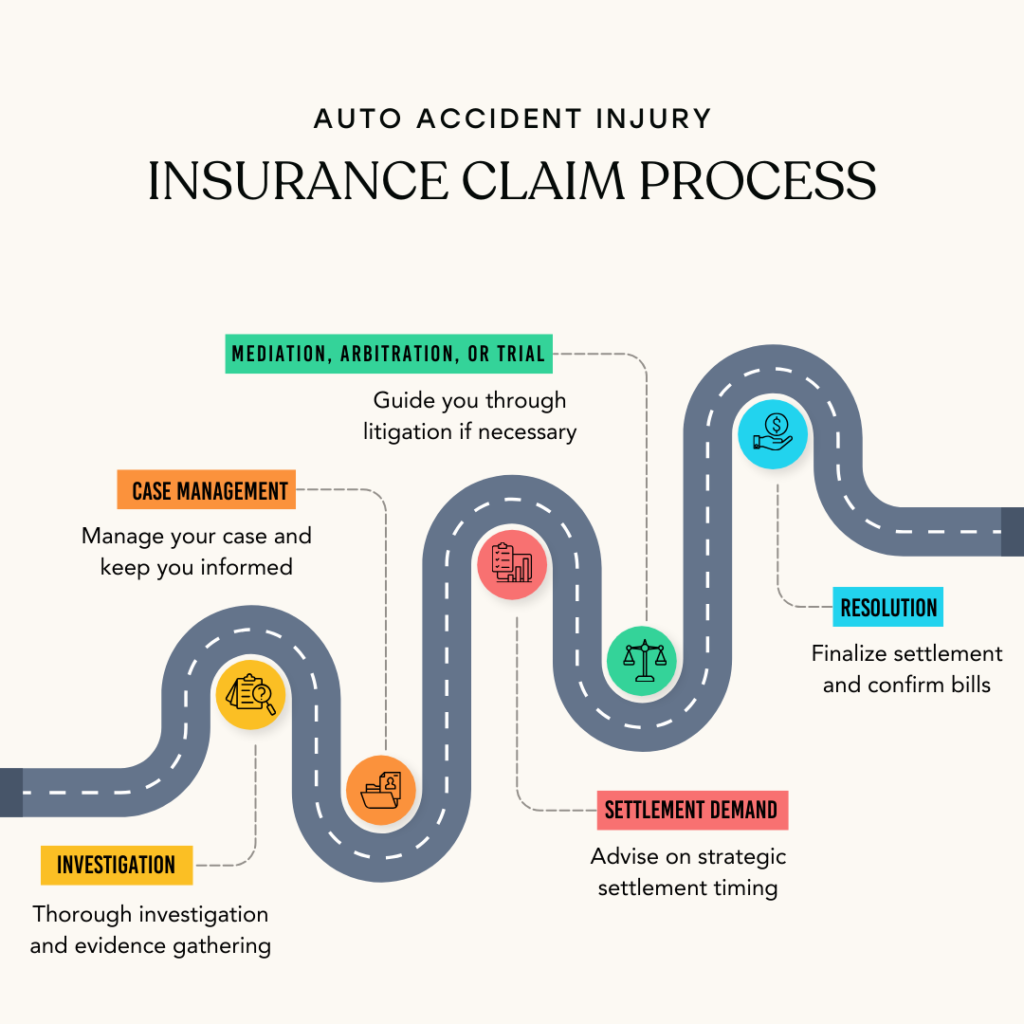

Why Working With a Car Accident Lawyer Matters

Insurance companies often try to settle claims for less than they’re worth. An experienced Washington car accident lawyer can help you:

- Gather the strongest possible evidence to support your claim.

- Negotiate aggressively with insurance adjusters.

- Calculate the full value of your damages to ensure you receive fair compensation.

- File a lawsuit if a reasonable settlement cannot be reached.

Take Action Today

If you’ve been injured in an intersection accident in Washington, don’t navigate the claims process alone. Washington Auto Law is here to help you fight for the compensation you deserve.

Contact us today for a free consultation and let our skilled attorneys guide you through every step of your case with confidence.