If you’ve been injured in a car or motorcycle accident in the Greater Seattle Area and missed time from work, you have the right to recover your lost wages from the insurance company. This includes any vacation time or paid time off (PTO) that you were forced to use. The at-fault driver who caused the accident is responsible for compensating you for this loss.

However, proving wage loss isn’t always simple. To strengthen your claim, you’ll need to provide clear documentation demonstrating that your injuries prevented you from working and resulted in a financial loss. Below are essential steps and tips to help you successfully prove your wage loss claim.

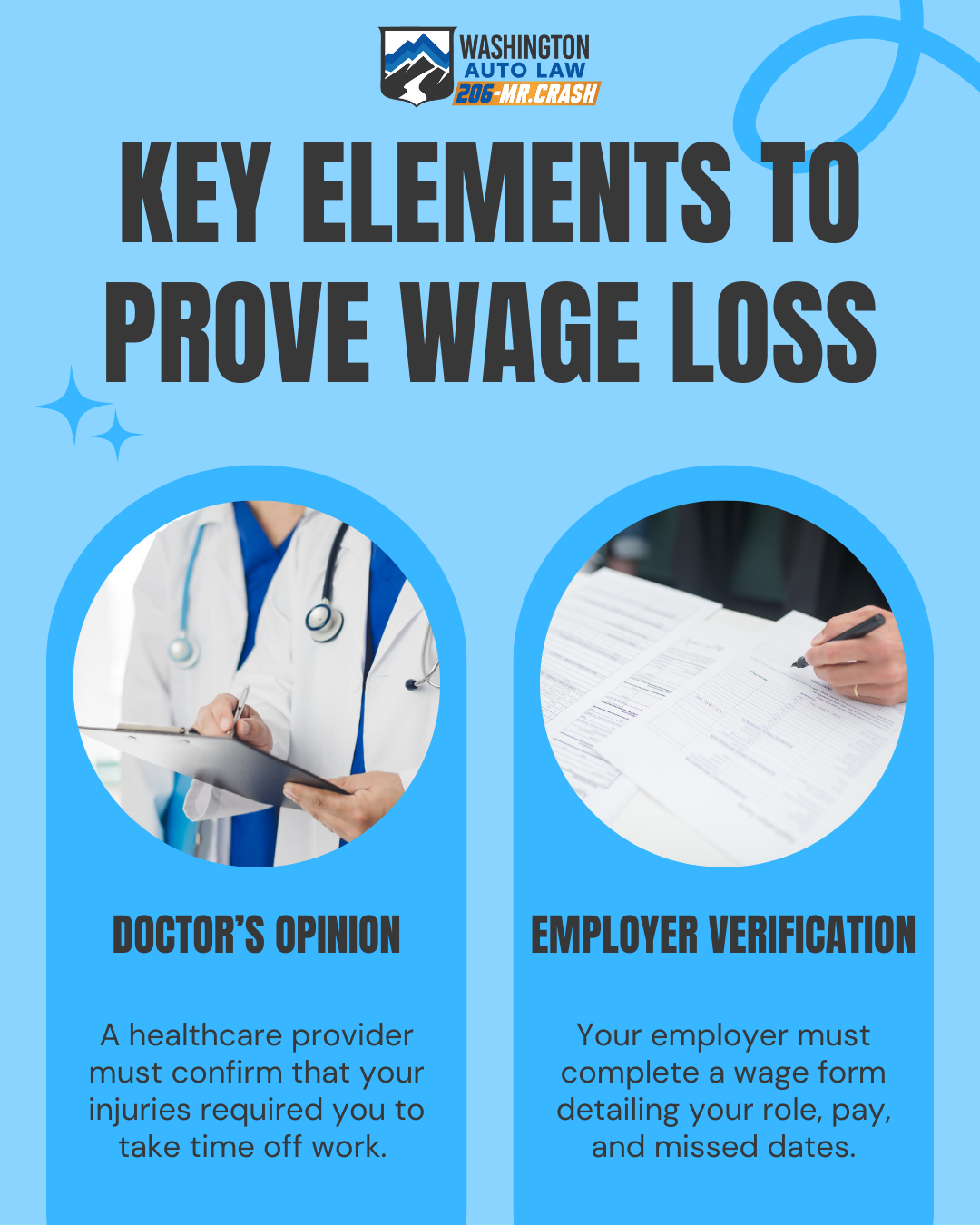

Key Elements to Prove Wage Loss in Washington State

There are two primary elements you must establish to support your wage loss claim: a medical opinion and employer verification.

- Your Doctor’s Opinion

A healthcare provider must confirm that your injuries required you to take time off work. To ensure your claim is strong:

- Seek medical attention immediately after the accident.

- Clearly explain to your doctor what you do for work and describe how your injuries affect your ability to perform your duties.

- Follow your doctor’s advice and keep detailed records of all medical appointments, treatment plans, and any prescribed rest periods.

Your doctor will provide documentation outlining your diagnosis, treatment plan, and the recommended duration for time off work. Without this, your claim may be rejected or delayed.

- Employer Verification

Your employer must complete a wage loss verification form that outlines your position, duties, pay rate, and the specific dates you missed work. This form serves as official proof of your missed earnings.

To ensure the process goes smoothly:

- Request the verification form as soon as you return to work.

- Keep a personal record of all the days you missed, including half-days or adjusted schedules.

- If your employer is slow to respond, follow up promptly to avoid delays in your claim.

Special Considerations for Unique Employment Situations

While proving wage loss can be straightforward in traditional employment settings, some scenarios may require additional evidence. If your situation involves any of the following, you may face added complexities:

Self-Employed Individuals

If you’re self-employed, you may not have a formal employer to verify lost income. In this case, you’ll need to provide:

- Tax returns from the previous year(s)

- Business invoices and contracts showing projected income

- Bank statements demonstrating income patterns

Periodic or Seasonal Income

For those with fluctuating income or seasonal employment, it’s essential to demonstrate your earning patterns. Supporting documentation might include:

- Pay stubs from past seasons

- Employer letters confirming typical work schedules

- Proof of accepted contracts or upcoming projects

Lost Overtime and Fringe Benefits

In addition to regular wages, you may also be eligible to recover:

- Lost overtime pay

- Bonuses or commissions you missed due to your absence

- Fringe benefits like pension contributions or employer-paid health insurance

Under-the-Table Income

If you are paid in cash or “under the table,” proving lost wages can be more difficult. Gather alternative evidence such as:

- Signed statements from clients or employers

- Bank deposit records that reflect consistent cash flow

- Copies of correspondence or job-related communications

Common Challenges in Wage Loss Claims

Despite your best efforts, some obstacles may arise. The following issues are common in wage loss claims:

- Disputes about whether your injuries truly prevented you from working

- Inconsistencies in medical documentation or employer verification

- Delays in submitting the necessary paperwork

To mitigate these risks, ensure your documentation is thorough, and maintain open communication with your employer and healthcare provider throughout the process.

Steps to Strengthen Your Wage Loss Claim

To improve your chances of receiving full compensation for your wage loss:

- Document Everything: Maintain a detailed record of all medical visits, work absences, and expenses.

- Communicate Clearly: Inform your employer about your injury and stay updated on any necessary paperwork.

- Seek Legal Assistance: An experienced personal injury attorney can help gather evidence, communicate with insurance companies, and maximize your compensation.

Conclusion: Take Action to Recover Your Lost Wages

If you were injured in a car or motorcycle accident in Bellevue or the Greater Seattle Area, don’t hesitate to pursue your right to recover lost wages. Gathering proper documentation and following the necessary steps is crucial to a successful claim.

Washington Auto Law has extensive experience helping clients recover lost wages following a car or motorcycle accident. Contact us today to schedule a free consultation and get the support you need to secure the compensation you deserve.