- Are Auto Accident Settlements Taxable in Washington State?

- Understanding Different Settlement Categories and Their Tax Impact

- How to Report Your Settlement on Your Taxes

- Key Takeaways for Washington Drivers

- What Should You Do Next?

Auto accidents are stressful, and dealing with the aftermath can be overwhelming—especially when it comes to financial recovery. If you’ve been in a car accident in Washington State, you may be entitled to a settlement covering medical bills, lost wages, property damage, and pain and suffering. But one key question many accident victims ask is: Will I have to pay taxes on my auto accident settlement?

Understanding the tax implications of your settlement is crucial to avoid unexpected financial burdens. In this article, we’ll break down what portions of your settlement may be taxable and how Washington State laws affect your situation.

Are Auto Accident Settlements Taxable in Washington State?

The good news for most accident victims is that settlements for physical injuries and medical expenses are generally not taxable under federal law. The Internal Revenue Service (IRS) does not require taxes on compensation meant to cover:

- Medical expenses related to treating accident injuries

- Pain and suffering directly tied to a physical injury

- Emotional distress stemming from a physical injury

- Attorney fees (if deducted from a non-taxable portion of the settlement)

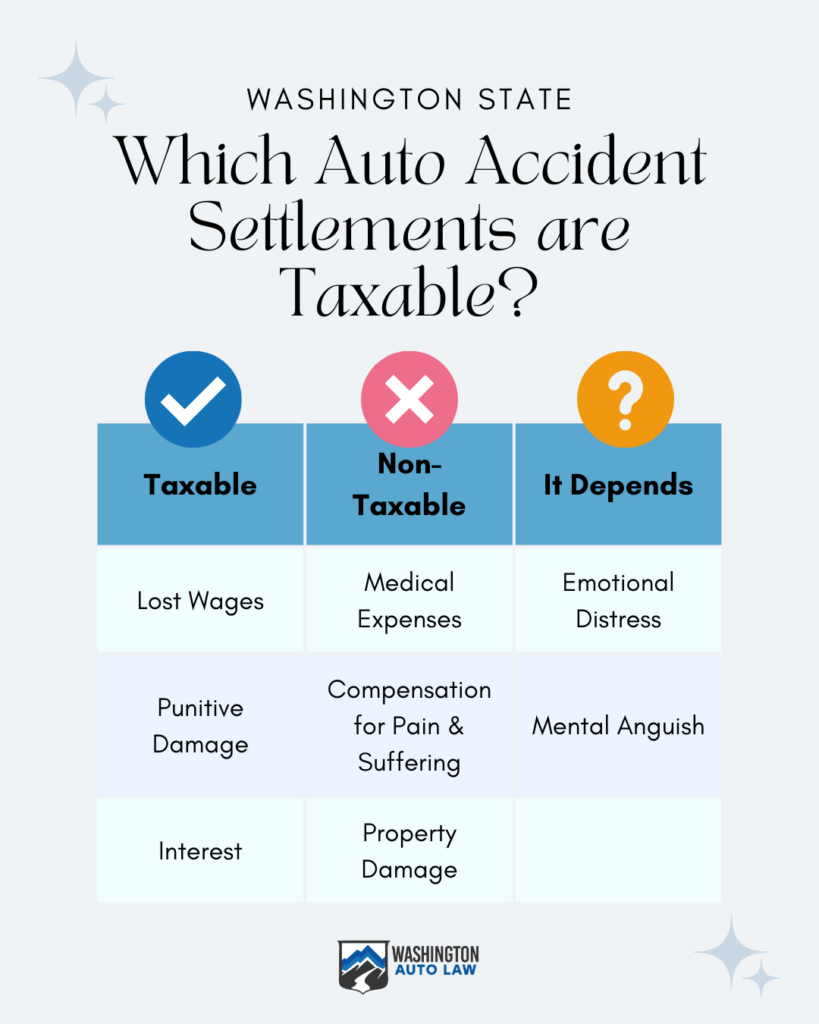

However, certain portions of a settlement may be taxable, depending on what they cover. Here’s when taxes might come into play:

- Lost Wages: If your settlement includes compensation for lost income, that portion is typically taxable because wages would have been taxable if earned normally.

- Property Damage: Compensation for vehicle repairs or replacement is not taxed if it does not exceed the vehicle’s adjusted value.

- Punitive Damages: These are rare in personal injury cases but are always taxable.

- Interest on the Settlement: If your settlement includes accrued interest, that portion is taxable.

What About Washington State Taxes?

Washington State does not have a state income tax, meaning you won’t owe state taxes on your settlement. However, if your accident occurred in another state with income taxes, you might be subject to that state’s tax laws. Consulting a tax professional can help clarify your obligations.

Understanding Different Settlement Categories and Their Tax Impact

Auto accident settlements can be complex, with different components affecting taxation. Here’s a closer look at the common types of compensation and their tax treatment:

1. Medical Expenses and Pain & Suffering (Non-Taxable)

Most of your settlement will likely go toward medical expenses and compensation for pain and suffering. Since these payments are meant to help you recover from a physical injury, they are not taxable.

However, if you deduct medical expenses from a previous tax return and later receive a settlement reimbursing those costs, that portion may be taxable under IRS “tax benefit” rules.

2. Lost Wages (Taxable)

If you missed work due to your injuries, your settlement might include compensation for lost income. Since wages are taxable when earned, the IRS considers this portion of your settlement taxable income.

3. Property Damage (Usually Non-Taxable)

If your settlement includes payment for car repairs or replacement, it is not considered taxable unless the payout exceeds the fair market value of your vehicle.

4. Emotional Distress & Mental Anguish (It Depends)

- If emotional distress stems directly from a physical injury, it is not taxable.

- If emotional distress is unrelated to physical injury (e.g., anxiety or PTSD from the accident), it may be taxable.

5. Punitive Damages & Interest (Always Taxable)

- Punitive damages, meant to punish the at-fault party, are always taxable.

- If your settlement includes interest (e.g., from a delayed payout), that portion is taxable as interest income.

How to Report Your Settlement on Your Taxes

If part of your settlement is taxable, you may need to report it on your federal tax return. Here’s how:

- Review Your Settlement Agreement: Your settlement should outline how compensation is categorized (medical, lost wages, etc.).

- Check IRS Forms:

- Report taxable portions (lost wages, punitive damages) on Form 1040.

- Use Schedule 1 for “Other Income” if required.

- Consult a Tax Professional: If unsure, an experienced tax advisor can help ensure compliance.

Failing to report taxable portions correctly can lead to IRS penalties, so it’s important to handle this correctly.

Key Takeaways for Washington Drivers

If you’re dealing with a car accident settlement in Washington State, keep these essential points in mind:

- Settlements for medical expenses and physical injuries are not taxable.

- Compensation for lost wages, punitive damages, and interest is taxable.

- Washington State does not impose an income tax, but out-of-state cases might be taxed.

- If you deduct medical expenses in a prior tax year, reimbursements may be taxable.

Understanding these tax rules can help you maximize your settlement while avoiding surprises when tax season arrives.

What Should You Do Next?

Dealing with an auto accident settlement can be complicated, and tax laws only add another layer of complexity. To protect your rights and financial interests:

- Consult a personal injury attorney to ensure you receive full compensation.

- Speak with a tax professional to understand any tax liabilities.

- Keep detailed records of your settlement breakdown for tax reporting.

At Washington Auto Law, we specialize in helping accident victims navigate the legal and financial challenges that come with auto accident claims. If you’ve been in an accident, don’t go through the process alone—contact us today for a free consultation. Our experienced attorneys will guide you every step of the way, ensuring you receive the compensation you deserve while helping you understand any tax implications.

📞 Call us today at 206-497-4357 or schedule your free consultation to get started on the path to recovery!