Table of Contents

- The Crucial Role of GAP Insurance in Vehicle Protection

- When GAP Insurance Becomes Essential

- Understanding Coverage Details and Provider Options

- Making Smart Decisions About GAP Coverage

- Protecting Your Financial Interests: Next Steps and Legal Considerations

The Crucial Role of GAP Insurance in Vehicle Protection

When purchasing a new vehicle, most buyers meticulously consider monthly payments, interest rates, and standard insurance costs. However, many overlook a critical financial protection that could save them thousands of dollars: GAP insurance. For Washington state residents financing or leasing vehicles, understanding GAP (Guaranteed Asset Protection) insurance isn’t just helpful—it’s essential for comprehensive financial protection.

GAP insurance serves as a vital financial safety net, bridging the difference between what you owe on your car loan and your vehicle’s actual cash value after depreciation. This coverage becomes particularly important when you consider that most cars lose approximately 20% of their value within the first year of ownership. This rapid depreciation creates a financial vulnerability that standard insurance policies don’t address.

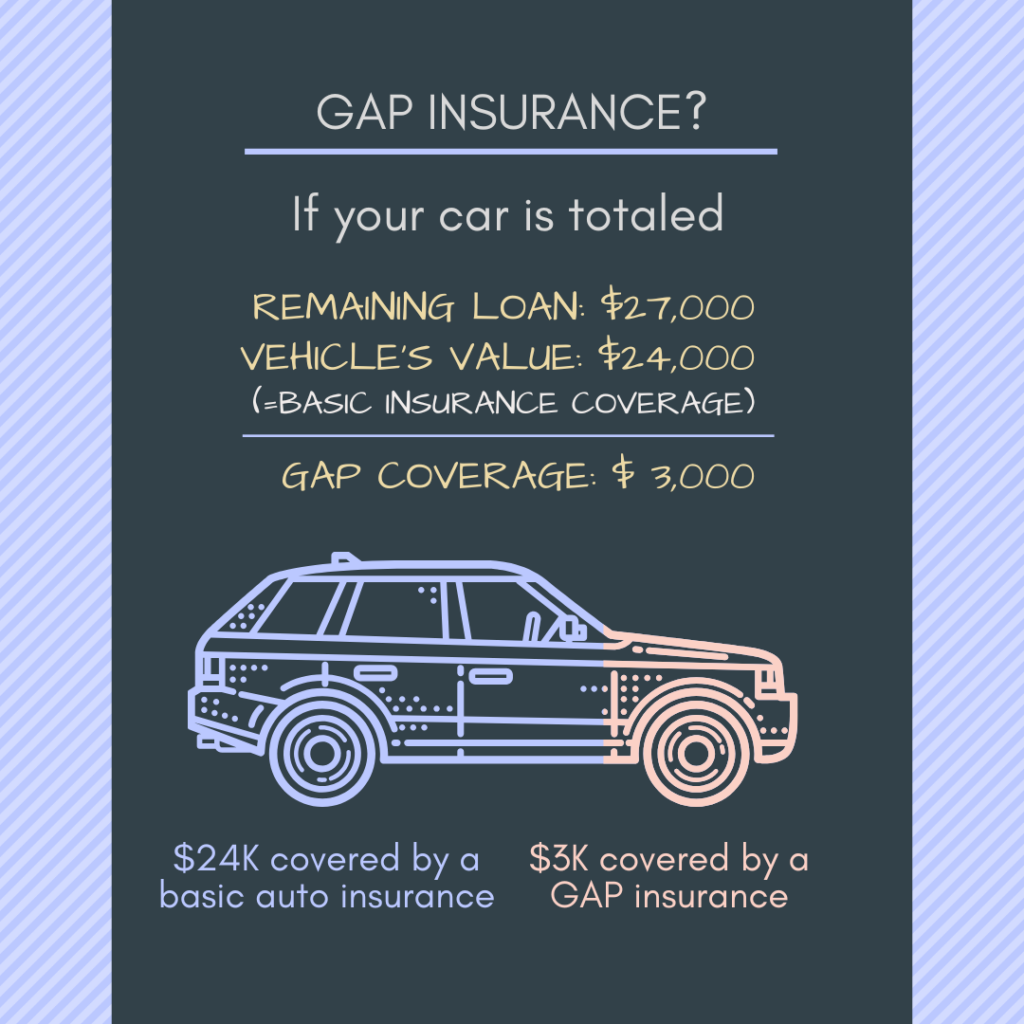

To understand the practical importance of GAP insurance, consider this common scenario: You purchase a new car for $30,000 with a minimal down payment. After a year, your loan balance stands at $27,000, but your car’s market value has dropped to $24,000. If your car is totaled in an accident, your standard insurance will only cover the market value of $24,000, leaving you responsible for the $3,000 difference. Without GAP insurance, you’d be paying for a car you can no longer drive.

When GAP Insurance Becomes Essential

GAP insurance proves particularly crucial in several common scenarios that many Washington drivers face. The most obvious situation is when making a down payment of less than 20% on a new vehicle. This minimal upfront investment, combined with rapid depreciation, creates an immediate gap between the loan amount and the vehicle’s value. Similarly, choosing a loan term longer than 60 months increases the period during which you might owe more than your car is worth.

The modern automotive market has made GAP insurance more relevant than ever. Today’s car financing trends frequently include loan terms extending to 72 or even 84 months, with many buyers making minimal down payments. These extended terms, while offering lower monthly payments, significantly increase the period during which your loan balance exceeds your car’s value. Additionally, the increasing trend of rolling over negative equity from previous loans into new car purchases creates an even larger potential gap that needs protection.

Understanding Coverage Details and Provider Options

GAP insurance specifically addresses total loss situations, whether from accidents, theft, or natural disasters. When such events occur, this coverage pays the difference between your standard insurance payout (based on actual cash value) and your remaining loan balance. However, it’s crucial to understand what GAP insurance doesn’t cover:

- Regular insurance deductibles

- Late payment fees or missed payments

- Extended warranties

- Negative equity from previous loans

- Regular maintenance or repairs

When seeking GAP coverage, you have two primary options: purchasing through your auto insurance company or through the dealership. Insurance company policies typically offer better value, usually costing around $20-30 annually when added to comprehensive coverage. These policies also tend to offer more flexibility, including the ability to cancel when no longer needed. In contrast, dealer-provided coverage often costs $500-700 upfront and usually gets rolled into your car loan, meaning you’ll pay interest on the coverage cost.

Making Smart Decisions About GAP Coverage

Your decision to purchase GAP insurance should be based on a careful evaluation of your specific circumstances. The coverage makes the most sense when financing a new vehicle with a minimal down payment or choosing an extended loan term. The timing of your purchase also matters significantly. Ideally, you should obtain GAP coverage when you first finance your vehicle, as the gap between your loan balance and vehicle value is typically largest in the early years of ownership.

Consider canceling your GAP coverage once your loan balance falls below your car’s market value, usually after 2-3 years of consistent payments. To determine this timing, regularly compare your loan statements with your vehicle’s current market value through reliable sources like Kelley Blue Book or NADA Guides. This proactive approach ensures you’re not paying for coverage you no longer need.

Protecting Your Financial Interests: Next Steps and Legal Considerations

When shopping for GAP insurance, take time to carefully compare options from both insurance companies and dealers. Request detailed quotes and pay special attention to coverage limits, exclusions, and cancellation terms. Remember that while dealer-provided coverage might seem convenient, it often comes with higher costs and more restrictions than policies from insurance companies.

Your financial protection shouldn’t stop with just purchasing GAP insurance. Understanding how to properly file a claim and navigate the claims process is equally important. This is where professional legal guidance can make a significant difference. At Washington Auto Law, our experienced attorneys understand the complexities of auto insurance claims, including GAP coverage disputes. We help ensure our clients receive the full compensation they deserve under their policies.

Don’t let a gap in coverage leave you financially vulnerable after an accident. Contact Washington Auto Law today at 206-497-4357 for a free consultation. Our team will review your situation, explain your options, and help you understand how to protect your financial interests both before and after an accident. We’ll guide you through the intricacies of GAP insurance claims and ensure your rights are protected throughout the process.